While real estate investors are naturally becoming more cautious during these choppy economic waters, the appetite for hotels remains stronger than with most asset classes. For that to continue, it’s time for the hospitality sector to get real about ESG, argues Bořivoj Vokřínek from leading advisory firm Cushman & Wakefield.

It’s not just individuals planning their next vacation who look excitedly through lists of hotels. The international investment community has also been ‘hot’ on hotel real estate for some years now; part of a wider shift towards operational real estate that saw record amounts of money being invested prior to the pandemic.

Even now, with darker economic clouds looming, hotel real estate has seen less decline in investor activity than other major property asset classes, some of which have experienced drop-offs in activity of up to 70%, compared with a more modest figure of less than 20% for hotels.

Why is this? And can hotels continue to be among the most resilient of asset classes? Who better to ask than a man who studies the sector in intimate detail: Bořivoj Vokřínek, who is Strategic Advisory & Head of Hospitality Research EMEA for Cushman & Wakefield, one of the world’s largest real estate consultancies. In addition to his ‘day job’ Bořivoj also guest lectures to Glion Bachelor students who’ve opted for the Hotel Development & Finance specialization.

“The attraction of hotel real estate is that it’s regarded as being well placed to withstand – and sometimes also benefit from – the structural changes we’re seeing in the economy and society.”

“The attraction of hotel real estate is that it’s regarded as being well placed to withstand – and sometimes also benefit from – the structural changes we’re seeing in the economy and society; some of them being amplified by the Covid pandemic,” Bořivoj explains. “There are challenges in the office sector, with many more people now working either hybrid or fully remotely; also, the pandemic accelerated the migration to online shopping, forcing many shopping centers and other retail real estate to reinvent themselves to stay relevant.

“Against this, travel and tourism has made an exceptionally strong comeback, with many hotels and hotel groups reporting financial performance above 2019 levels. Profit is also holding up despite the big increases we’ve seen on the expenses side. So, while there has been some hurt in the hotel investment market, it’s very much a case of ‘you should see the other guy’.”

“Travel and tourism has made an exceptionally strong comeback, with many hotels and hotel groups reporting financial performance above 2019 levels. Profit is also holding up despite the big increases we’ve seen on the expenses side. So, while there has been some hurt in the hotel investment market, it’s very much a case of ‘you should see the other guy’.”

Bořivoj Vokřínek

The bigger picture

Bořivoj points to a number of macro ‘pull’ factors that underpin the positive outlook for hotel real estate, together with other ‘living sector’ assets such as senior housing, student accommodation and healthcare facilities.

These include rising incomes in the longer term, notably in developing economies, which are fueling the desire to travel. In addition, many of us now have more time to travel, as working patterns evolve to provide greater opportunities for remote work; some employers are even trialing four-day-weeks, with obvious implications for long weekend style breaks. Globalization is another major factor, in particular the increased connectivity through enhanced transport infrastructure that makes traveling easier than it was even 10 or 20 years ago.

There’s also the much-cited generational shift away from spending on goods towards spending on experiences. As just one example, Bořivoj cites a McKinsey study pointing out that spending on experiences in the US has been growing four times faster than that on goods. He adds that the rise of social media – notably Instagram – has given an outlet in which to ‘share’ experiences with the broader social network, echoing the expression of one’s personality, lifestyle or success in life that was the function of goods such as clothes or cars for previous generations.

These macro factors aside, investors are also attracted by the broader range of return-and risk profiles offered by hotels. Bořivoj notes, “In office, residential or retail, everything is based around the lease, and these are primarily fixed; you have tenants, and you collect your lease payments from them – it is relatively low risk but also low return investment. With hotels, there’s a whole spectrum of risk and return scenarios. You can have fixed leases, variable leases, or management contracts, or owners can operate their hotels directly with a franchise or as a non-branded property. Furthermore, with an operational business like a hotel, there are way more opportunities to significantly increase the value of the property through active asset management.”

Editor’s note: click here to read more about the growing power of the hotel asset manager.

To provide a flavor of how hotel asset management works in practice, Bořivoj cites examples such as renegotiating the operating contracts. There can also be opportunities to deploy technology and optimize the space utilization within the property, such as relocating the executive lounge to the ground floor and adding more guest rooms, turning empty areas in the lobby into a vibrant café, grab-and-go pantry shop, co-working space or a flower shop enhancing the hotel entry.

For assets which may be losing their competitive edge, the solution can be a significant renovation and repositioning that targets other growing segments (from a midscale business hotel to an affordable lifestyle brand or extended-stay product, for example).

“We are now in an era when capital has a higher cost; and in that environment an investor needs to be able to generate higher returns. Hotels are one of the few asset classes that offer the potential of generating the kind of enhanced returns that can still justify the increased cost of capital.”

Where’s the money going?

While the overall hotel investment market may have been affected by the unprecedented increase in financing cost as well as today’s economic and geopolitical concerns, Bořivoj notes that a deeper dive reveals wide differences between markets. For example, while the UK and Germany remain among the largest hotel investment markets, each has seen something of a slow-down in activity, while France and Spain continue to see growth.

The recent focus towards southern Europe is primarily driven by investors’ increased appetite for resorts, underpinned by constrained supply and the strong growth of leisure demand. In addition, the extended stay sector is benefiting from rising investor interest, boosted by its resilience during the pandemic, the flexibility such properties offer to switch between tourism and residential uses, and also because this sector should be a beneficiary of the ongoing shift of our society towards a mobile lifestyle.

“Having said that, the luxury hotels in the key gateway markets continue to be an attractive asset class, that has proven to be a very effective hedge against inflation and economic downturns with the additional benefit of owning a distinctive physical asset,” Bořivoj adds.

ESG the game-changer

So far, so good then. But there’s one factor that no serious hospitality investor can afford to ignore, and that is ESG: environment, social and governance.

The implications of ESG – especially in relation to energy intensity and carbon footprint – are huge across all segments, but particularly among hotels that are dependent on corporate business, according to Bořivoj.

“Hotel owners and operators are seeing more and more corporate clients referring to these metrics in their RFPs (requests for proposal) for conferences and business contracts. Companies have to know about the hotel’s carbon footprint because they have to account for it in their own ESG reporting.”

The data backs this up. According to the Global Business Travel Association, some 53% of North American companies have corporate sustainability programs that affect their decision to contract with a travel supplier.

Bořivoj adds, “It’s not just about the sales side. From the operational point of view, energy is very expensive right now, and that impacts the bottom line. Based on our calculations, the gross operating profit could have been on average 7% higher across major European markets, if the utility cost had stayed the same as in 2019”.

The other huge, and growing, issue concerns the regulatory environment around environmental/sustainability performance (see this Insider article for more insights). From a consumer perspective, however, the picture is clouded somewhat due to the lack of an all-pervasive, robust and transparent system of measurement and rating. Bořivoj notes that early iterations, such as the ever-proliferating ‘green badges’, remain something of a ‘Wild West’ scenario.

“If you are weighing up which refrigerator to buy, you’ll find each one has a sticker on it with a very clear, universal energy rating. It’s not the same for hotels, where various green badges and labels are so widely distributed it can’t realistically be the case that all these hotels have become energy and resource-efficient overnight”.

“In fact, our research indicates that whereas over 60% of hotels in major markets across Europe that are listed on Booking.com have the Travel Sustainable Badge, only around 4% actually have any verified third-party certification to support these sustainable claims.”

The ‘green’ premium

How are ESG concerns feeding through to investor sentiment? Cushman & Wakefield can offer the best insight into this, as the firm has surveyed investors directly on how important sustainability is becoming to their decision making. The survey found that the expected premium for hotels with the highest ESG credentials is approximately 6%.

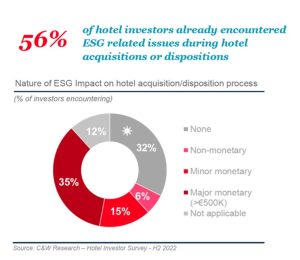

Another survey by Cushman & Wakefield asked whether investors had encountered any issues relating to ESG when disposing or acquiring hotel assets. More than half said ‘yes’, and out of that number, some 15% said these had resulted in a minor monetary impact, with 35% saying they suffered a major monetary (i.e. over €500K) impact. Others noted delays in completing transactions which, though they had no direct financial impact, are headaches that any investor would prefer to avoid.

Perhaps unsurprisingly, thinking ahead to avoid ESG-related pain points when selling an asset is becoming ingrained in the purchase process, with 71% of the investors polled by Cushman & Wakefield saying they already include ESG assessments within their due diligence, plus a further 12% saying they are working on adding it.

“Hotels are big ticket assets, so nobody wants to end up holding an expensive hot potato they can’t easily dispose of. And with regulation moving so fast, investors are naturally concerned that something they buy today could become unsellable in five years’ time because it doesn’t comply with the new regulations,” Bořivoj adds.

He also believes that the impact on consumer behavior will be felt more deeply once today’s abundance of sustainability measurement and rating systems consolidates into a handful of trusted and all-pervasive certification systems.

“As long as it remains tricky to differentiate which hotels are really sustainable, I think we’ll see consumers continuing to be led by other more traditional factors, such as location, price, brand, facilities, etc. Eventually the certification ecosystem will undergo a period of natural selection and pressure from regulators, leaving us with only few established and recognized systems, and this will make things much clearer for people, which should translate into more revenue for hotels that are sustainable”.

“Having said that, we shouldn’t just assume that highlighting hotel sustainability credentials is the right marketing strategy for all consumer groups, especially in the luxury segment. Sometimes people want to splash out and indulge and might fear their experience will be limited by sustainability measures. Thus we see some operators quietly implementing sustainability measures but not talking about it, so the guests don’t feel short-changed. It’s what some call ‘green shushing’ instead of “green washing.”

- Thank you for your insights on this fascinating topic, Bořivoj! To discover more about Cushman & Wakefield’s EMEA Hospitality practice, click here

Photo credits

Main image: Tzido/Getty

Construction shot: Zetter/Getty

Energy rating: Patrick Herzberg/Getty

Get into real estate

Our Master’s in Real Estate, Finance & Hotel Development – taught exclusively in London – is a proven entry point to the global real estate sector.